Guidance and support reporting investment sales We'll walk you through reporting sales of stocks, bonds, and mutual funds. Automatically import your investment info We can automatically import investment info directly from participating financial institutions. Extra guidance for new businesses We'll show you the startup tax deductions for new businesses so you can get the maximum refund you deserve. Maximize next year's refund Understand your tax history and know your “tax health“ with expert tips to help you get an even bigger refund next year.Įmployee tax forms Prepare and print unlimited and for your employees and contractors. More TurboTax Home & Business CD/Download features. Self-employed Income Perfect for entering multiple sources of income, including 1099-MISCs and sales from goods and services.

QUICKEN HOME AND BUSINESS MAC FOR MAC

TurboTax Home & Business Federal + E-File + State 2012 for Mac Download You Save: $37.54 (38%) Helps you get every dollar you.Īnswers as you go Free U.S based product support and easy-to-understand answers online 24/7. Expenses made easy We'll walk you through expense categories and offer additional tax-deduction suggestions. Vehicle tax deduction Let us determine if actual or the standard mileage rate will get you the biggest tax deduction. We know your industry Don't miss any tax write-offs–we'll help you spot overlooked tax deductions for your industry. Self-employed deductions We'll tell you which expenses you can deduct such as phone, supplies, utilities, home office and more. Quicken 2012 Home And Business Tutorial.

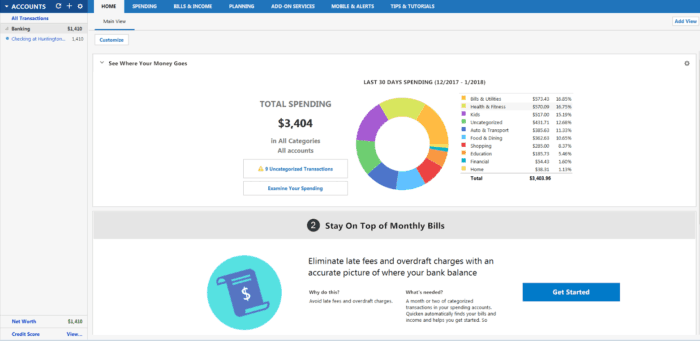

Quicken displays the total for that tag, as well as a list of all expenses that have that tag. Then, to see how much that vacation cost, you can go to the Spending Cloud (under the Reports section of the Source list) and click the "Florida vacation" tag. You would create a tag called "Florida vacation" and then apply that tag to any expense that's going toward that vacation, like your flight, your rental car, your hotel room, meals, maybe even a new bathing suit, and a boat rental. And while you can only assign one category to each transaction, you can assign as many tags to each transaction as you like.įor example, suppose you want to know how much you're spending on a vacation to Florida. While categories are assigned to similar types of expenses, tags usually get assigned to expenses from different categories. Tags, on the other hand, let you see how much you're spending for a specific purpose, like a hobby or a vacation. For transactions that Quicken doesn't recognize, (e.g., your rent check), you'll need to categorize those manually until Quicken learns that your payment to "Mr. Quicken automatically categorizes many of the transactions you download, based on your past categorizations and based on its knowledge of which payees belong in which categories. And because only a single category can be assigned to each transaction, category tracking can help you create reports that show you exactly what proportion of your money is going to which kind of expense. Differences between categories and tagsĬategories are used for similar types of expenses. Later, to see the total cost of your vacation, run a custom report by including all transactions with the vacation tag. Here are some transactions that you might associate with this tag: It's very easy using tags! Just create the tag vacation and associate all your related transactions, from multiple categories, with this tag. You went on a vacation with your family and you need to keep track of all the expenses related to this vacation. They help you group and analyze all transactions related to a specific event. Tags provide an additional way to classify and group your transactions. For example, bills and utilities, paycheck, business income, etc. It helps you easily analyze your transactions. This grouping is displayed in reports and graphs. In Quicken, categories and subcategories are used to classify and group your transactions.

0 kommentar(er)

0 kommentar(er)